Construction Accounting: Keeping Your Construction Business Profitable and Organized

Construction Accounting: Keeping Your Construction Business Profitable and Organized

Blog Article

Discovering the Importance of Building Accounting in the Building And Construction Market

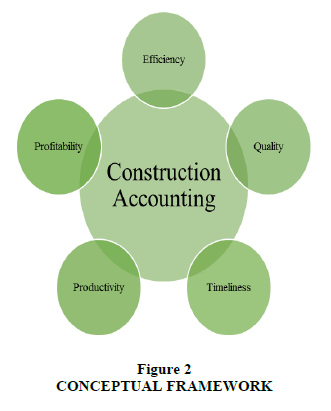

The construction industry runs under distinct financial obstacles that demand a customized technique to audit. Building and construction bookkeeping not only guarantees the precision of financial coverage but also plays an essential function in task management by enabling efficient job setting you back and resource allowance. By recognizing its key principles and benefits, stakeholders can substantially influence task results. Nonetheless, the complexities fundamental in building accounting raising concerns regarding best practices and the tools available to manage these complexities efficiently. What techniques can building companies carry out to optimize their financial processes and drive success?

Unique Difficulties of Building And Construction Accounting

Often, building accountancy presents special obstacles that distinguish it from various other industries. One main challenge is the complex nature of building and construction projects, which frequently entail several stakeholders, fluctuating timelines, and differing guidelines. These factors demand precise monitoring of prices connected with labor, products, devices, and expenses to maintain task productivity.

An additional substantial challenge is the requirement for accurate job costing. Building and construction business need to designate prices to details projects properly, which can be difficult as a result of the lengthy duration of jobs and the possibility for unanticipated expenditures. This requirement demands robust accountancy systems and practices to ensure timely and specific economic reporting.

Furthermore, the building market is vulnerable to transform orders and contract adjustments, which can even more make complex monetary monitoring and forecasting. Appropriately representing these modifications is essential to prevent conflicts and make certain that jobs remain within budget plan.

Secret Principles of Building Accounting

What are the fundamental concepts that guide building accounting? At its core, building accountancy rotates around accurate tracking of expenses and earnings connected with certain tasks.

One more secret principle is the application of the percentage-of-completion technique. This strategy identifies income and costs proportionate to the task's progression, providing a more reasonable sight of economic efficiency with time. In addition, building and construction bookkeeping highlights the value of conformity with accountancy requirements and laws, such as GAAP, to ensure transparency and integrity in economic coverage.

In addition, cash circulation management is vital, offered the frequently intermittent nature of building jobs. Timely invoicing and managing repayment schedules help keep liquidity. Last but not least, efficient budgeting and projecting are vital for expecting project costs and economic outcomes, making it possible for far better decision-making and resource allocation. These principles jointly develop a robust structure that supports the unique economic demands of the construction sector.

Benefits of Reliable Construction Audit

Efficient building and construction bookkeeping gives various benefits that substantially enhance the general monitoring of projects. One of the key benefits is enhanced economic visibility, allowing project managers to track expenditures properly and monitor money flow in real-time. This transparency helps with informed decision-making, lessening the threat of budget overruns and making sure that sources are allocated efficiently.

Furthermore, efficient construction bookkeeping improves conformity with governing needs and industry requirements. By preserving precise monetary documents, firms can quickly supply paperwork for audits and fulfill legal commitments. This persistance not only fosters count on with clients and stakeholders however likewise minimizes possible lawful threats.

In addition, reliable accounting practices add to better project projecting. By analyzing past efficiency and economic fads, building and Continue construction companies can make even more exact forecasts relating to future job expenses and timelines. construction accounting. This capability enhances calculated planning and enables companies to react proactively to market changes

Tools and Software Application for Construction Accounting

A selection of specialized devices and software program remedies are offered for building accounting, each made to enhance monetary management procedures within the market. These tools promote monitoring, reporting, and examining monetary information certain to building projects, ensuring precision and compliance with sector requirements.

Leading software choices include incorporated building management systems that encompass task administration, budgeting, and bookkeeping performances. Solutions such as Sage 300 Building And Construction and Property, copyright for Professionals, and Point of view View deal features customized to handle task setting you back, payroll, and invoicing, making it possible for construction companies to keep precise monetary oversight.

Cloud-based applications have gotten appeal due to their ease of access and real-time cooperation abilities. Devices like Procore and CoConstruct permit teams to gain access to economic information from numerous areas, boosting communication and decision-making processes.

Furthermore, building and construction bookkeeping software application typically sustains conformity with governing requirements, Click Here assisting in audit routes and tax obligation coverage. The assimilation of mobile applications further boosts operational efficiency by allowing field personnel to input data straight, lowering mistakes and hold-ups.

Finest Practices for Building Financial Management

Effective construction accounting counts not just on the right tools and software yet visit this web-site additionally on the execution of finest practices for financial monitoring. To accomplish effective financial oversight, building and construction companies ought to focus on exact and routine project budgeting. This procedure includes damaging down task expenses into thorough classifications, which enables far better monitoring and projecting of costs.

One more crucial technique is maintaining a durable system for invoicing and capital monitoring. Timely invoicing makes certain that settlements are received without delay, while persistent cash money flow surveillance helps stop liquidity issues. Furthermore, building and construction business need to adopt a strenuous technique to work costing, examining the actual costs against spending plans to identify variations and readjust approaches accordingly.

Furthermore, fostering transparency with thorough financial reporting improves stakeholder depend on and help in educated decision-making. Regular monetary evaluations and audits can likewise discover possible inadequacies and locations for improvement. Finally, constant training and advancement of monetary administration skills amongst team make certain that the group continues to be experienced at browsing the intricacies of construction accounting. By integrating these best practices, construction firms can boost their financial stability and drive task success.

Final Thought

Finally, construction accountancy functions as a fundamental part of the building industry, attending to unique obstacles and adhering to vital principles that enhance monetary precision. Efficient audit methods yield substantial benefits, consisting of improved capital and compliance with regulatory requirements. Making use of suitable devices and software better sustains financial monitoring efforts. By carrying out ideal methods, construction companies can foster stakeholder depend on and make informed decisions, eventually adding to the overall success and sustainability of jobs within the market.

Building bookkeeping not just makes certain the precision of economic coverage yet additionally plays a critical function in job administration by allowing effective job costing and source allowance. Furthermore, building accountancy highlights the significance of compliance with accountancy requirements and policies, such as GAAP, to guarantee transparency and reliability in economic coverage.

Effective building bookkeeping relies not just on the right devices and software program yet likewise on the application of best techniques for economic administration. Constant training and development of economic monitoring skills among team make sure that the group remains adept at browsing the complexities of construction accountancy.In final thought, building accounting offers as an essential part of the building industry, resolving special challenges and sticking to essential concepts that improve economic precision.

Report this page